PayPal is one of those companies people love to hate. I know I do. But sometimes, PayPal shows how good it can be. And in some ways — please don’t hate me for saying this — PayPal has some WordPress-y-ness in the struggles it faces as a platform.

PayPal has been around a long time, has a lot of technical debt, and faces challenges when changing due to its widespread use. The platform has a lot of quirks, most of them beyond what I’m familiar with, but will be more familiar to any of you extensively developing integrations with it. But for all its saltiness, PayPal is incredibly popular, easy to check out with, and has some good features.

I thought it’d be fun to highlight some of the good stuff PayPal has going for it.

Reference transactions

Running subscriptions with PayPal is tough. Once someone sets up a recurring subscription with PayPal, that is that. There is no changing it. So if you want to edit the payment amount, skip a payment, postpone the payment date, or really anything at all, you have to cancel the recurring payment and hope the person is willing to resubscribe. I’ve been doing this with my subscriptions lately, in some instances. Except that’s not always the case any more!

Reference transactions are a manually enabled feature of PayPal that make it much more flexible for recurring subscriptions. When reference transactions are enabled, you can edit all of the things I listed above, which makes managing subscriptions through PayPal much easier. Unfortunately, enabling reference transactions isn’t that simple, and the feature doesn’t apply to old subscriptions.

Requesting PayPal to enable reference transactions is pretty well described by the Prospress team over on the WooCommerce Subscriptions docs. I used nearly identical text to Prospress’s recommendation when I emailed PayPal. They followed up quite quickly, and asked me for four key points before enabling the feature:

- Business justification, to briefly explain the business model

- Number of repeat customers

- Number of reference transactions per customer

- Projected total payment volume of reference transactions

So, I emailed them back, using estimates based on my 2015 sales, but I did fib a little bit, because only about half of last year’s sales went through PayPal. You can see my answers here. Being able to answer these questions is important, because apparently they may reject you if you don’t meet a transaction threshold (rumored to be maybe around $5,000 revenue per month).

So while reference transactions are pain to request and hope for, the process is quick once you get started, and if they approve you, then you have about the same level of flexibility in editing PayPal subscriptions as you do with Stripe, and that’s a win!

$0.50 flat payment fees

Did you know you can bypass the $2.9 + $0.30 per transaction fee on PayPal? Well, you can, under certain circumstances, receive payments for only a $0.50 fee, even for payments exceeding $10,000. That’s about a $300 savings on such a large transaction!

- Accounts must be US based

- Both payer and receiver must have PayPal accounts

- Customer must pay via PayPal account

- Payment may be delayed around 7 days, like an eCheck payment

These are relatively severe limitations, but for some of you at least, it could be a real money saver. Also, your invoicing software may or may not support it. I know Freshbooks, Harvest, and Zoho support it. Check yours to see if they do! Freshbooks has a pretty good blog post about how to enable it, but there’s nothing you need to do on your account side.

For Post Status, my partner agreements are $2,500 each, and I think 8 of 12 partners paid with PayPal last year. That’s over $500 I could save, so a big win for when it fits your situation.

Flexible payback PayPal loans

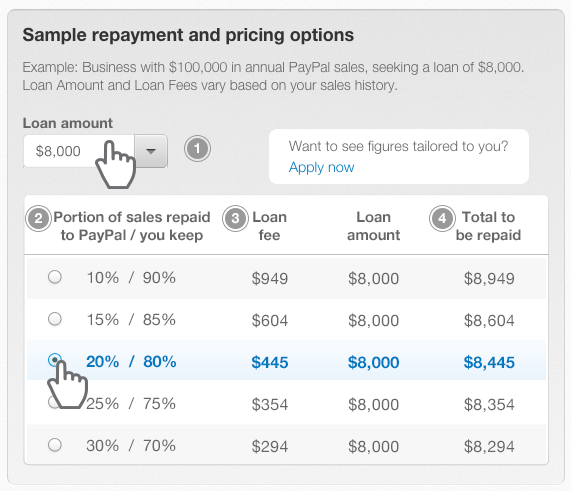

This one is a little terrifying, but also a really helpful solution if you just have a cashflow issue. PayPal has a PayPal Capital program that allows you to borrow money, pay it back by paying a flexible percentage of future transactions, for a flat fee that equates to fairly low interest rates.

The program is slightly complicated, but their landing page does a good job explaining. A few helpful features apply here:

There isn’t a credit check. Your eligibility is based on your PayPal payment history.

You can get money pretty quickly.

It’s handy for small loans (someone at PayPal told me it starts at $1,000 and can go to upwards of $100,000).

The percentage fee you pay (like interest, except not, which I’ll explain) varies, but in their example is between 3.5% and 12% depending on what percentage you pay of future transactions to cover the loan.

So if you put 20% of future transactions toward the loan, then you pay a lower fee than if you only put 10% of future transactions toward the loan.

A downside to this is for really short term loans. If you know you only need the money for 2 weeks before you can pay it back in full, then you’re paying that fee for a two week loan, which on a yearly adjusted interest rate is super high. But if you pay it back slowly, then it’s quite handy. Still, like a friend told me when discussing this program with him (they’d done it a couple times), the fee isn’t a big deal if it means you make payroll and just need the cash until the big check you’re waiting on clears.

This is a lot simpler way to borrow a small amount of money than going through a bank. And compared to borrowing against a credit card or other non-ideal method, it’s a good deal. Cash is king for most businesses, and PayPal has devised a pretty interesting way to help small businesses get periodic needed cash infusions.

You can build your entire business around it

PayPal still frustrates the crap out of me often. But it definitely has advantages. For instance, you can use the PayPal card reader or a PayPal point of sale system for brick and mortar stores. Combine that with their eCommerce stuff, and it’s compelling to just use PayPal for everything.

And I’ve had only good experiences with PayPal’s support. Like, surprisingly good.

Anyway, I like to hate on PayPal sometimes. The quirks can kill. But it doesn’t make it an awful platform. People pay with PayPal because it’s easy. And there is something about paying for something with your PayPal balance that makes it feel like it’s not real money. That alone makes it a compelling option to include on your website.

So while I’ll continue to work around PayPal’s quirks, I figured it’d be good to talk about some of its better features.

PS: Pretty much all of these things were discussed in our #wpbusiness and #ecommerce channels on Slack. Hop in to those excellent little communities-inside-the-Post-Status-community if this is your kind of thing!